A Global Merchant Bank

Advising Leading Family Offices and

Long-Term Investors

About Us

Securities are offered through Hollister Associates, LLC, Member FINRA, Member SIPC. Participant and Hollister Associates, LLC are not affiliated entities.

Check the background of investment professionals on FINRA’s BrokerCheck.

Participant enables family capital and other long-term investors to successfully invest in attractive companies and enables businesses to access this unique source of capital

Participant also advises a select group of long-term strategic investors including select Pensions and Sovereign Wealth Funds

Participant's mission is to serve as a trusted partner and advisor to our clients. We strive to provide the highest quality strategic advice and transaction execution capability across direct investing, mergers and acquisitions, capital placement and financial advisory services

Participant's network of more than 500 of the world's largest family offices and other long-term investors actively investing across a range of industries, stages and geographies

Participant deeply understands the dynamics and specific needs of privately held businesses and offers a unique platform to bridge the gap between long-term capital and entrepreneurs

Leadership Team

Our founders bring investment expertise, hands-on operational know-how and experience advising many of the world’s largest family offices and long-term investors

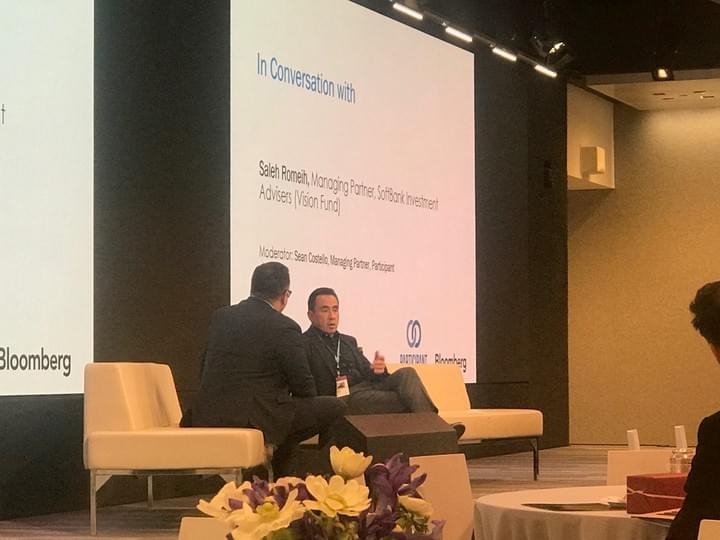

Sean Costello

Managing Partner

Sean has more than 25 years financial markets experience in US and Europe across investment banking, equity research and UHNW/ Global Family office private banking. He has worked in senior roles at firms including Morgan Stanley, Lehman Brothers, Barclays, and RBC. Sean's clients include some of the largest family offices globally and he has led numerous private equity transactions on behalf of these family offices. He has extensive experience in debt and equity markets including leading multi-billion transactions.

Sean is a honors graduate of the University of Pennsylvania and holds an MBA from Duke University’s Fuqua School of Business. In addition, he currently sits on the European Advisory Board of the Fuqua School of Business as well as several family office and foundation investment committees in the US and Europe.Contact: scostello@participant.capital

Michael Kurdziel

Managing Partner

Michael brings experience both working with family offices in the private equity and venture space to managing the direct investing activities for leading family offices. He has more than 20 years of experience in investment banking and private equity investing at Morgan Stanley and Merrill Lynch. Michael has led Private Equity investing for several family offices, and has experience sourcing and managing venture capital investments. He was a co-founder of a venture capital backed technology firm, DealerTrack (NASDAQ: TRAK), which secured more than $75mm in financing before going public in 2005. Over the course of his banking and private equity career, he has led numerous equity and debt transactions totalling more than $1 billion in value. Michael's areas of expertise also include structured credit and debt placement. Michael serves on the board of several private companies and non-profits.

He earned his BA from Trinity College with high honors and an MBA from Duke University’s Fuqua School of Business.

Contact: mkurdziel@participant.capital

Daniel Costello

Managing Partner

Daniel most previously worked for five years as SVP of global M&A and Strategy at News Corp. Under his leadership, News Corp completed over $2.5 billion of investments including the acquisitions of Move.com ($1B, US), Harlequin ($400M, CA), Unruly ($200M, UK), Wireless Group/Sports Talk ($200M, UK), Storyful ($20M, Ireland), as well as additional acquisitions across multiple technology and media sectors in India, Thailand, Australia and Europe. Daniel previously founded a London-based research firm, Titan Advisers, which provided research and financial analysis to both corporates and large global institutional investment firms. Daniel worked for over a decade as a journalist for The Wall Street Journal and the Los Angeles Times as a financial journalist covering economics, healthcare and politics.

Daniel earned his BA from the University of Pennsylvania with a degree in economics and Japanese, and an MBA from Duke University’s Fuqua School of Business.

Contact: dcostello@participant.capital

Kevin Smith

Managing Director

Kevin Smith joined the leadership team in January, 2023 bringing over 24 years of asset management, alternatives investing, private capital raising, and investment banking experience. Prior to joining Participant, Kevin served as a senior member of the business development team at CrossBay Capital Partners. Preceding CrossBay, he was a Senior Managing Director, member of the senior management group, and Head of North America business development for global institutional asset manager, State Street Global Advisors ('SSGA'). Before joining SSGA in 2005, Kevin was a Senior Vice President and senior member of the Venture Capital Services Group at Lehman Brothers in New York, focused on capital raising and cross-selling private wealth services to financial sponsors. Earlier in his career, he was an investment banking senior associate in Boston with State Street Capital Markets, LLC, where he was engaged in middle-market M&A advisory mandates and raising growth equity for technology and life science companies. Prior to his time at State Street, he was an analyst with Aberlyn Capital Management, a life science venture debt firm that targeted medical device, diagnostic and therapeutic companies. He began his career in the management training program at Shawmut Bank in CT. Kevin holds a BA from Trinity College and an MBA with Distinction from Wake Forest University. He is also an active volunteer in his community, serving on the boards of multiple non-profit organizations

Karen Mitchell

Chief of Staff

Based in London, Karen Mitchell works with Participant on strategic initiatives, communications, and high-end global event management. As well as supporting Participant, Karen is the founder of Giraffe which is a bespoke strategic communications firm where she and her team manage and host large scale, exclusive exhibitions and events globally and develop integrated communications for their clients (e.g. TV, social, and print campaigns). Giraffe is especially proud of the work they have done creating and hosting numerous global trade missions to China as well as opening the external calendar for the 69th UN General Assembly at the United Nations Headquarters in New York for UN Women supported by Yoo Soon Taek, the wife of UN Secretary General Ban Ki Moon.

Karen has owned Giraffe for the last 20 years and during that time has worked with global clients including Santander, Barclays, Capgemini, Commonwealth Business Council, UK’s National Health Services, AbbVie, College of Medicine, Keyline Brands, WIE (Women Inspiration & Enterprise), HIMSS UK, Department of Health, Bahamas Government, Godrej UK, Philips, UKTI, LDNY Foundation, Macmillan Cancer, Bupa, Parkinson’s, Duchy Originals, Kidney Care and NHS England.

Global Network

We are passionate about introducing our clients to each other and encouraging dialogue between them. Our summit's are invite-only and only open to single family offices. We tailor the content to their needs with a high profile speakers from principals of family offices to heads of Industry. Our summits are never filmed or recorded and all conversations are classed as off the record.

Family Office Summit

London, May 2019Hosted by Bloomberg

Our speakers included:

- Ariane de Rothschild, Chairwoman of the Board of Directors of

Edmond de Rothschild (Suisse) SA - Jeremy Ferrar, Director, The Wellcome Trust on Global Philanthropy,

and Healthcare Innovation and Outcomes

Family Office Summit

New York, May 2018Hosted by Bloomberg

Our speakers included:

- Dr. Rajiv Shah, President, Rockefeller Foundation,

on Global Philanthropy - Ambassador William J Burns, President of the Carnegie

Endowment for International Peace, Fmr. Dep. Sec of State,

Fmr. Ambassador to Russia

- Ariane de Rothschild, Chairwoman of the Board of Directors of

Advisory Services

Participant works with leading independent and family-owned businesses to access and secure long-term strategic investors. We support our clients in the following ways:

Mergers and Acquisitions

Participant offers a tailored approach to family offices and long-term investors and businesses that are seeking to acquire or sell companies in a wide range of industries and stages. We provide a full suite of M&A services including sourcing, due diligence, valuation, structuring and deal execution

Debt and Equity Placement

Participant assists clients in securing equity and debt capital for growth, recapitalization and liquidity. We source capital from traditional investors, as well as from our unparalleled network of more than 500 of the world's largest private investors

Strategic Advisory

Participant provides advice to family-owned businesses and other companies. We work with clients to identify growth opportunities, explore corporate alliances, and develop M&A strategies. We leverage our extensive global/local relationships to provide our clients with balanced and insightful judgment on key strategic and financial initiatives

Fund Formation

Participant helps to raise capital for both new and established funds on a selective basis. We concentrate on differentiated investment strategies that are well-aligned with the longer term focus and sector expertise

Direct Investing

Participant develops and co-manages direct investment programs for family offices and long-term investors on direct investments into attractive businesses.

We work as an advisor alongside family offices and long-term investors to manage their direct investment initiatives providing:

Private Equity Program

Participant works with family offices and long-term investors to develop direct investment programs focused on Private Equity. a comprehensive approach to managing direct private equity activities, with services ranging from strategy formation and sourcing to investment management and exits. Our platform covers all aspects of direct investing

Venture Capital Program

Participant partners with family offices and long-term capital to manage their venture capital programs. We take a comprehensive approach to managing venture activities, with services ranging from strategy to entity formation to investment management and exits. Our approach covers all aspects of the corporate venture capital

life cycle

Co-Investment Sourcing

Participant leverages our global network of the world's leading families and strategic investors to source investments from well-aligned co-investors. Families in our network invest from venture capital through large buyouts

Family Office Formation

Participant understands what it takes to successfully create a sophisticated family investment platform. We advise family offices on developing investment strategies; building out investment capabilities; and recruiting a world-class teams

Investment Focus

Participant's clients invest in companies with exceptional growth potential

Our clients' direct investing varies by industry, geography and stage. All companies in which we invest share common attributes of market leadership, innovation and an ability to thrive in the New Economy

We seek investments on behalf of our family office and long-term investor partners in many sectors including the following:

Key Characteristics

- Strong growth potential

- Sustainable, recurring revenues

- Competitive advantage

- Strong management

- Clear market leadership

- Deep addressable market

Sectors & Industries

- Venture: $1m to $25m

- Growth: $10m to $150m

- Buy-out: up to $500m EV

- Special Opportunities

- Primary Equity Focused

- Structured / Mezzanine Debt

Sectors & Industries

- Business Services

- Financial Services

- Healthcare

- Media & Technology

- Retail & Consumer

- Special Opportunities

Locations

We are a global firm working with clients across various geographies

New York

Boston

London

Keep Updated

If you would like to receive our quarterly newsletter or contact one of our team, please complete the form below.

Securities offered through Hollister Associates, LLC. Member FINRA, SIPC. Participant Capital and Hollister Associates, LLC are not affiliated entities. Check the background of investment professionals at FINRA's BrokerCheck.

FINRA in Member FINRA / SIPC) to www.finra.org

SIPC in Member FINRA / SIPC) to www.sipc.org

FINRA's BrokerCheck to https://brokercheck.finra.org/

© 2013 - 2017 Copyrights Participant, LLC All Rights Reserved